by Ted Farry | Oct 12, 2018 | 1031, Investing With Conatus 101, single family rental property

Why You Should Sell A California Rental and Buy Single Family Rental in Texas Conatus Real Estate is a Single Family Rental Investment Platform. We help California real estate owners with large gains to monetize the equity in their property without paying capital...

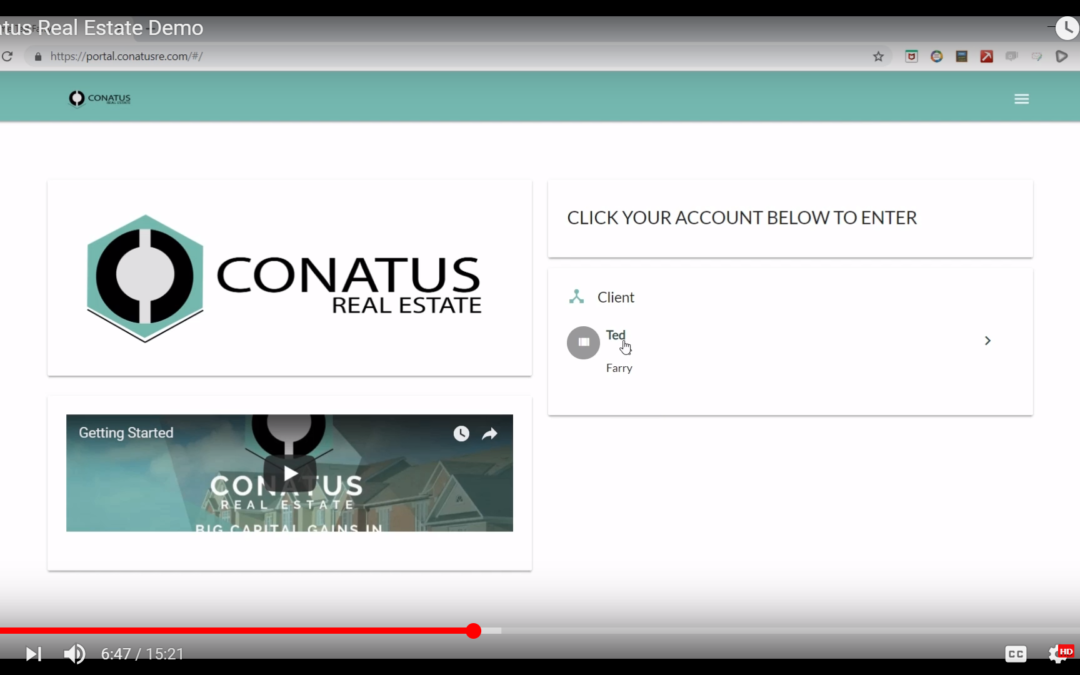

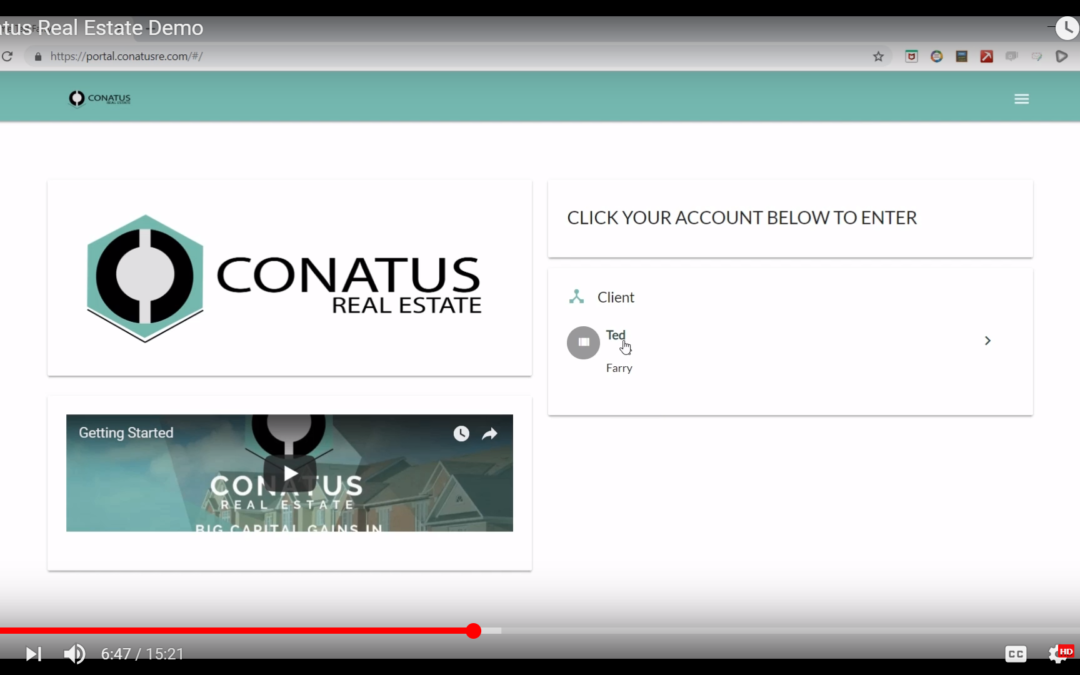

by Ted Farry | Oct 9, 2018 | 1031, Investing With Conatus 101, single family rental property

What Does Conatus Real Estate Do? Conatus Real Estate Demo Conatus Real Estate is a Single Family Rental Investment Platform. We help California real estate owners with large gains to monetize the equity in their property without paying capital gains taxes. Many times...

by Ted Farry | Oct 2, 2018 | single family rental property

Techxpert Property Management Series Webinar – Single Family Rental Conatus Real Estate President Ted Farry recently joined Linda Liberatore for a discussion about all things Single Family Rental on her Techxpert Property Management Series Webinar. Watch the...

by Ted Farry | Sep 12, 2018 | 1031, Investing With Conatus 101, single family rental property

ALTERNATIVE MINIMUM TAX A supplemental income tax imposed by the United States federal government required in addition to baseline income tax for certain individuals, corporations, estates, and trusts that have exemptions or special circumstances allowing for lower...

by Ted Farry | Aug 28, 2018 | 1031, Investing With Conatus 101, single family rental property

1% RULE The one percent rule refers to the rent to cost ratio a single family rental investment property must have in order to be profitable as a rule of thumb. While there are a number of expenses to keep in mind, the monthly rent on an investment property must be at...

by Ted Farry | Mar 3, 2018 | 1031, single family rental property

The Tax Cuts and Jobs Act of 2017 changed the realm of acceptable application of IRC Section 1031. The remaining acceptable uses benefits Real Estate Investors as all but uses in real estate were removed. Here’s how real estate investors can benefit from a 1031...