California is About to Get Boring

Last night I had the opportunity to hear Bruce Norris speak at the OCREIA monthly real estate investment club meeting. Mr. Norris or “Bruce” always at least quadruples the attendance vs. other meetings. In many rooms around southern California he is nothing short of a god. Setting ontology aside, every time I have listened to Bruce speak, I have walked away with solid insight. Last night was no different.

After a bit of book talking, he dug in to my favorite part of his presentations, the charts! In 2006, Bruce published The California Crash. So what is he saying now? Things are about to get boring.

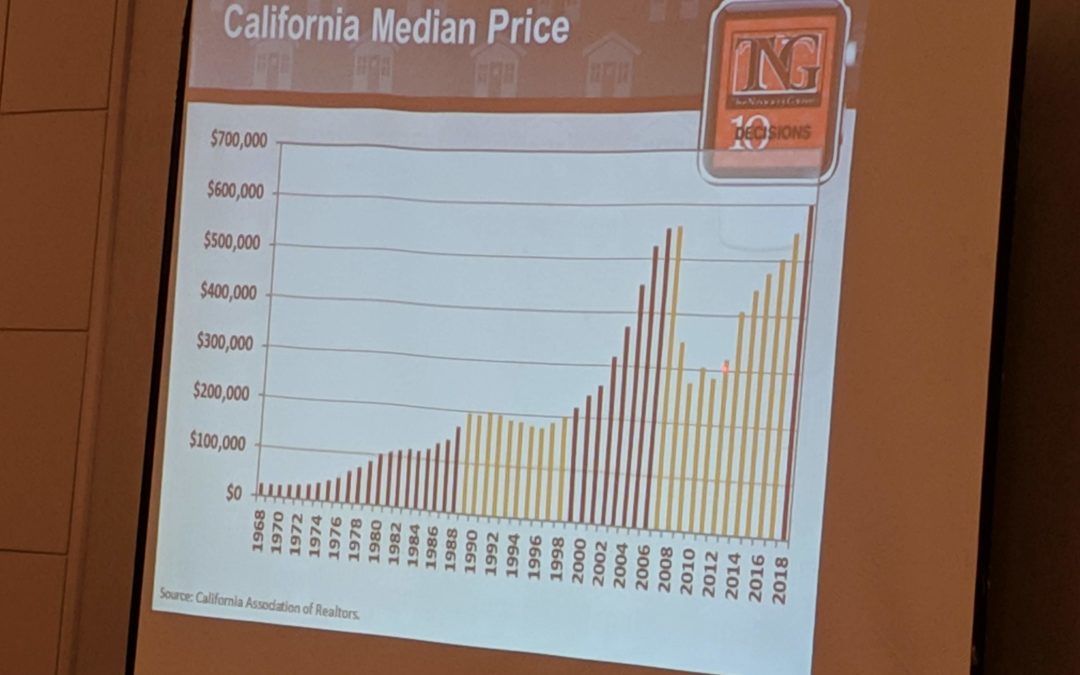

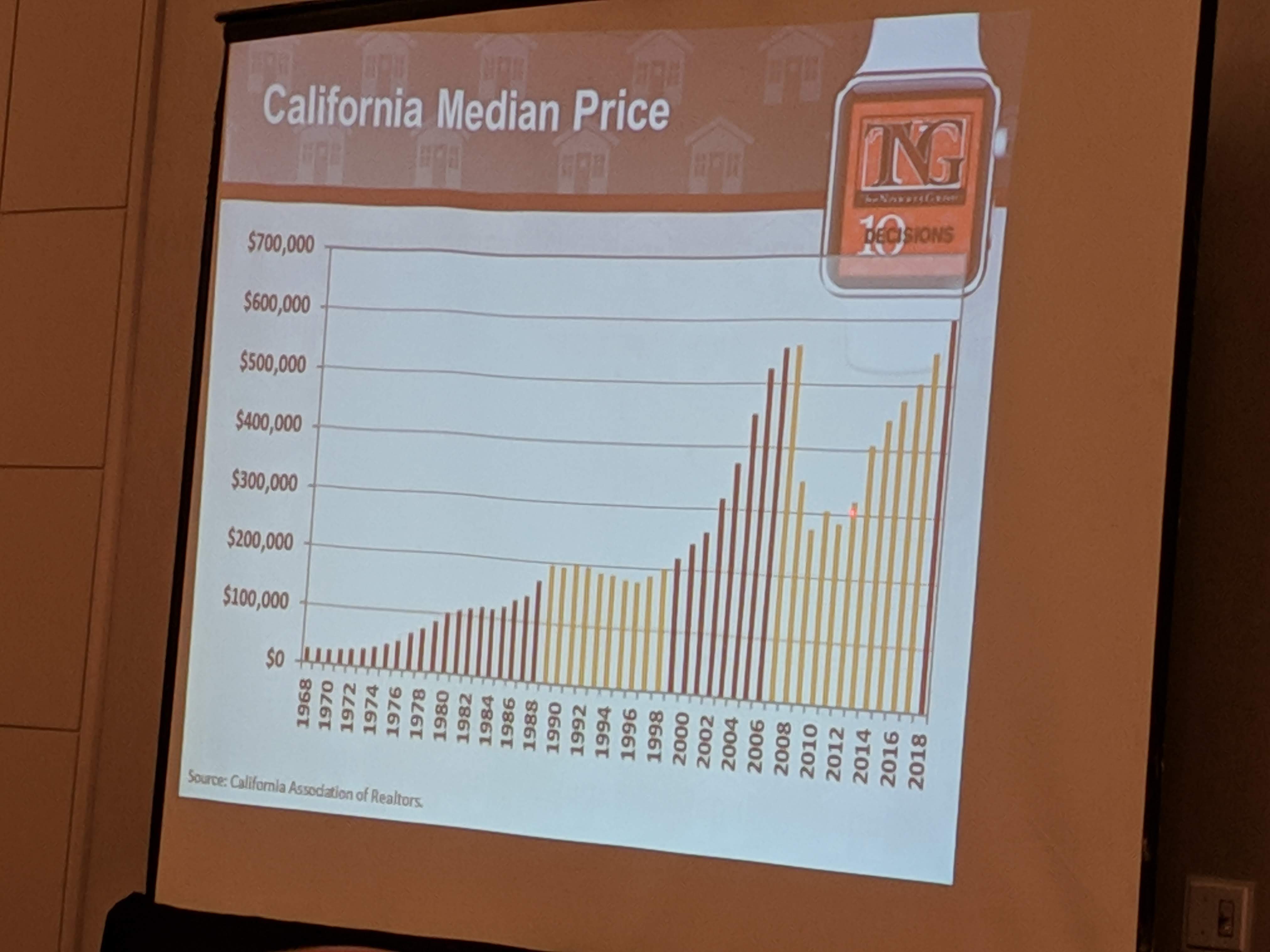

Mid-presentation he changed his statement from “where are in the top of the 8th” to just “we are in the 8th inning.” From the chart above though, we can see that not every downturn looks the same. While the most recent downturn, fueled by excessive foreclosures, was devastating, he pointed out that they are not all like that. We could go through a period like ’81-’84 or ’89-’96. The chart shows much less dramatic value drops during these periods. It is important to note that throughout the presentation Bruce stressed the importance to draw your own conclusions.

What do you do now?

The premise of his whole presentation is about what can you still do now to optimize your portfolio before we lose the market. He stated that “there is still a lot that can be done in 2019”.

Another point I appreciated was about the difference in market acceptance of “flawed” inventory in a hot market vs. a cold one. The main goal in real estate investing is to buy the highest quality property at a discount. The most likely periods we as investors can execute this is during distressed times, if at all. What happens though as markets start to emerge from distressed status, is that we begin to become priced out of the highest quality properties and are forced to go down in quality stream in either property class (ie A, B, C, etc) and/or geography (ie the best neighborhood vs. one that is not as good) to maintain similar return profiles. Inherently, this initiates momentum in to what can be classified as “flawed” property. The slide below highlights a few key takeaways – “in a hot market, the deals you find are often flawed inventory and they sell anyway. In the bottom of the 9th inning, they don’t sell.”

So what do you do?

1031 Exchange

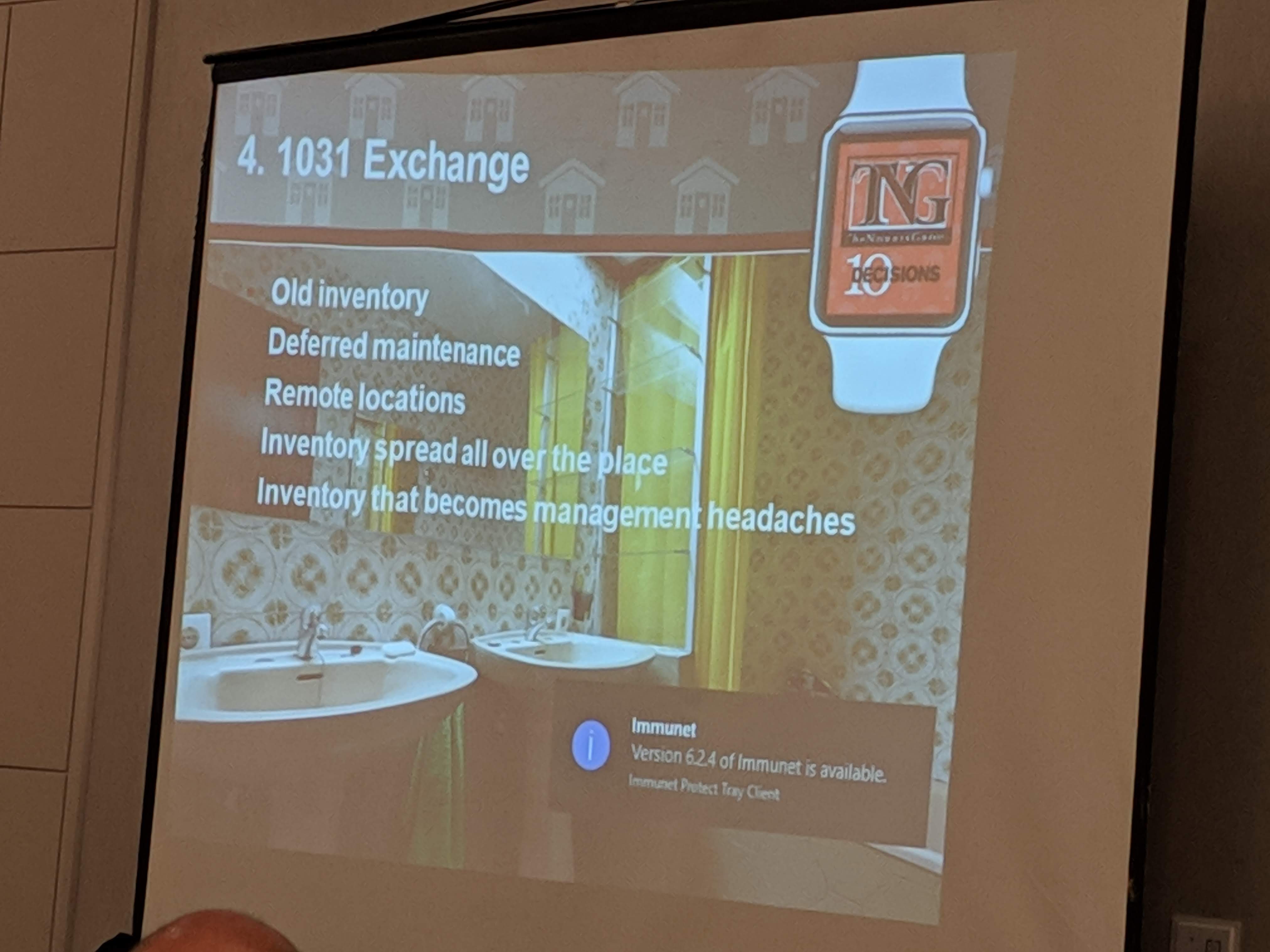

Bruce pointed out that now can be a good time to do a 1031 exchange. He stated that a 1031 exchange can be a good way to replace old inventory, property with deferred maintenance, remote locations, inventory spread all over the place and inventory that becomes management headaches.

Here at Conatus, we would add that a 1031 exchange can also be a good way to trade low current cash flow properties with higher ones. The best way to understand this is to look at the Cap Rate against the current value of the property. In areas that have seen high appreciation like California, where values have increased by dramatically more than the rental rates, the result is a low cap rate. An investor can use a 1031 exchange to trade this low cap rate for a higher one to increase current cash flow return.

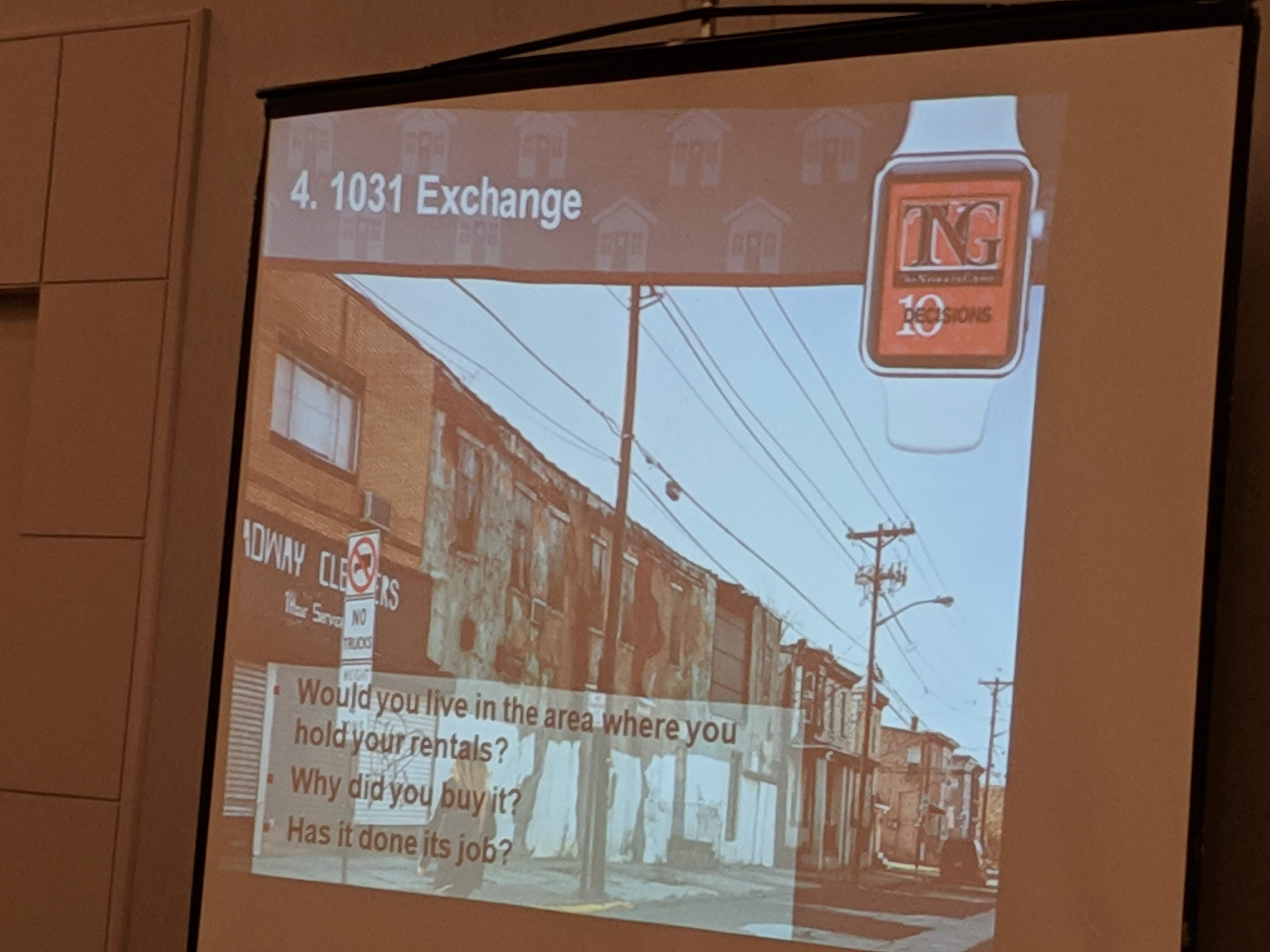

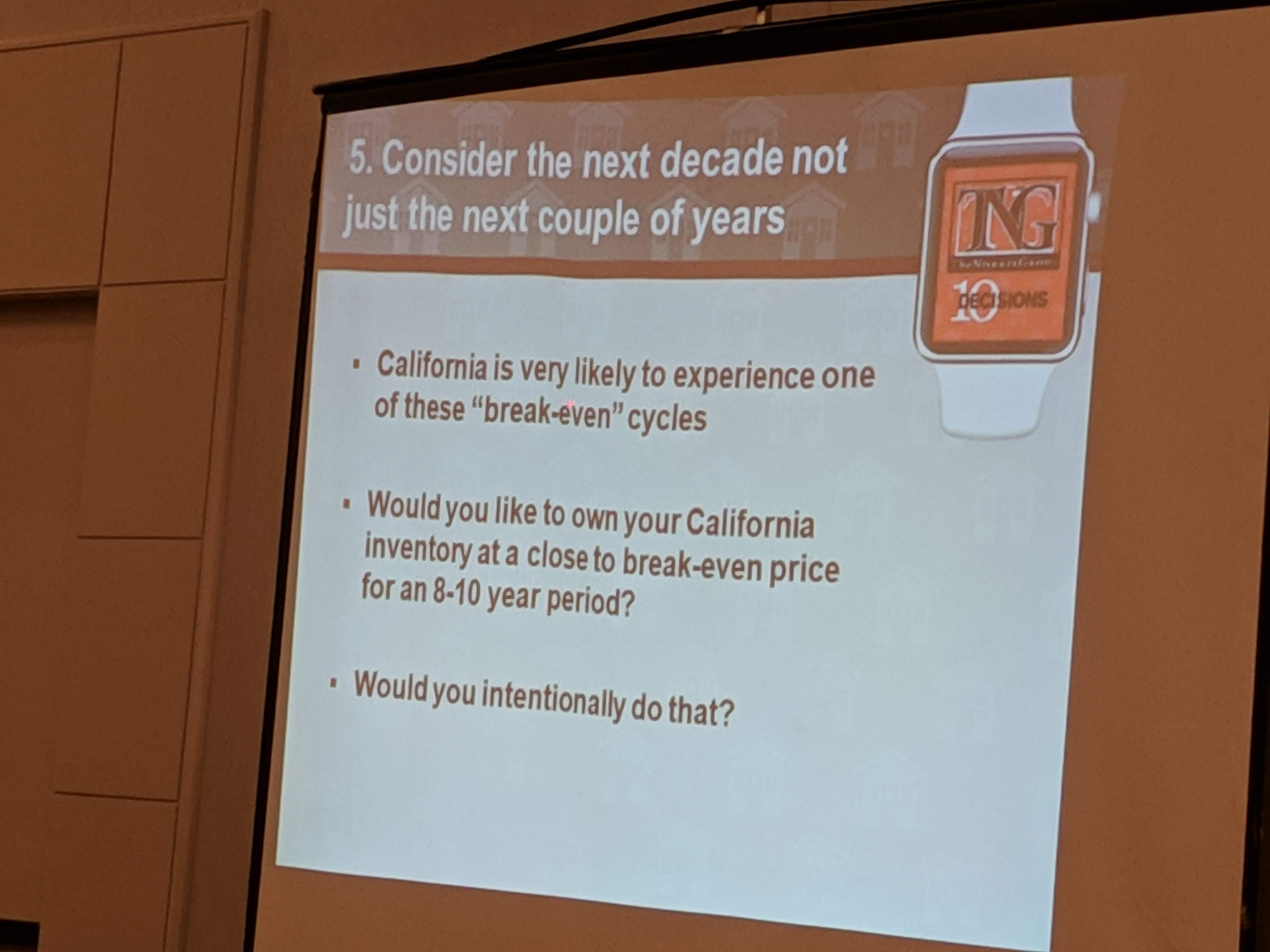

Because of the time constraints and other pressure of a 1031 exchange, some investors may be inclined to settle for property they normally wouldn’t, to avoid the tax bill. Bruce pointed out a few questions each investor in a 1031 exchange should ask themselves.

Why is California going to become boring?

Cash Flow

As you can probably start to see, the conversation is veering toward cash flow. The probability of achieving the same rate of returns from value appreciation in the near future vs. the near past is low. Appreciation is sexy, risky and fun. Cash flow is consistent, conservative and …boring. Where do you find high cash flow returns in this market? Bruce likes Florida.

Definitely a poignant slide. Bruce likes Florida because a “more experienced” population with money is moving there. As this population gets older, they need people to take care of them and that drives even more people to move there. Conatus likes Texas because businesses are moving there in droves. Along with each business comes all of its employees. Employees need places to live. Neither state has any personal income taxes (I can hear all of the Californians jaws hitting the ground.)

Takeaways

In conclusion, like every other time I have had the opportunity to listen to Bruce Norris speak, this presentation did not let me down. The insight about where we are headed can drive some thought. What does real estate investing look like in a “boring” market?

I like single family rental because of the yield profile where ~60% of the return comes from current cash flow yield.

I also think that it is a good thing for professional flip platforms that have effective tools at their disposal to source discounted property. The removal of the training wheels that an appreciating market provides everyone, weeds out platforms and individual investors that don’t have the necessary tools – tight processes, valuable sourcing channels and pricing analytics understanding. Well equipped platforms gain some space to move, the volatility created from value change removes itself from the equation and real value can be created from sourcing and execution.

One principle that all investors should be doing at every point in the cycle, take time to understand what is happening in the environment around you, draw your own conclusions and pick the strategy that is right for you.