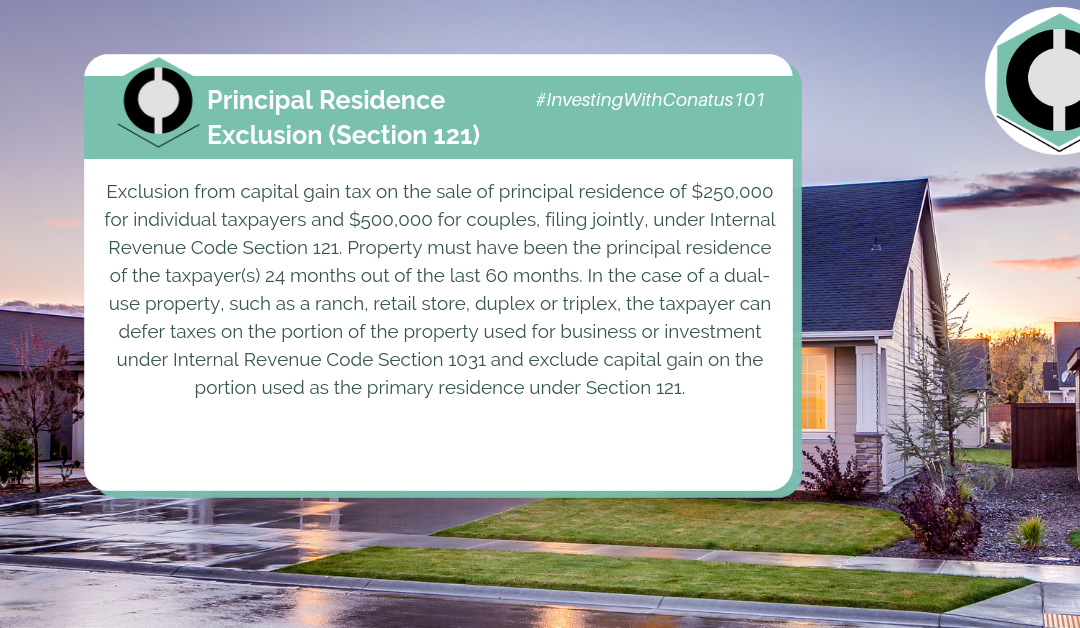

Principal Residence Exclusion (Section 121)

A Principal Residence Exclusion (Section 121) exclusion from capital gain tax on the sale of principal residence of $250,000 for individual taxpayers and $500,000 for couples, filing jointly, under Internal Revenue Code Section 121. Property must have been the principal residence of the taxpayer(s) 24 months out of the last 60 months. In the case of a dual-use property, such as a ranch, retail store, duplex or triplex, the taxpayer can defer taxes on the portion of the property used for business or investment under Internal Revenue Code Section 1031 and exclude capital gain on the portion used as the primary residence under Section 121.

If after learning a bit more about a Principal Residence Exclusion (Section 121) you are curious to see how your current Investment Portfolio would benefit from performing a 1031, then I recommend signing up to receive a FREE 1031 Sizing from Conatus.

This sizing gives you info about the value of replacement properties you need to purchase and the amount of related debt on this purchase to fully defer your capital gains associated tax liability.

As an added benefit you will receive a comparison of your current income vs potential replacement property income that includes an assessment of income tax benefit between the

two.

The Conatus 1031 Sizing is your blueprint for how to maximize cash flow from trading your equity for a multiple on income.

Get My 1031 Sizing